Discover 2022 performances of French Real Estate Investment Vehicles

THE FRENCH PUBLIC REAL ESTATE FUNDS RAISED MORE THAN 16 BILLION IN 2022

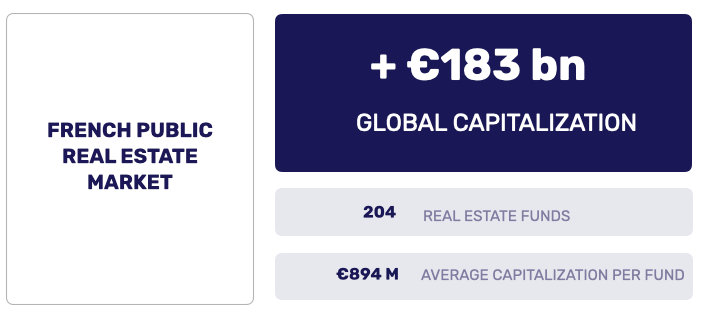

March 21st, 2023 – For the 4th year in a row, Rock-n-Data has carried out an annual study of the performance of 204 French Public Real Estate Funds (called Pierre-Papier in France). The total capitalization of these funds represents more than €183 billion, with an average of almost €900 million per fund. More than €16 billion were raised in 2022, This shows that real estate public funds continue to attract more private investors and are showing excellent results.

Total market capitalization increased by more than 11% compared to 2021

Over 2022, the French Public Real Estate Funds once again generated strong interest among investors. As a reminder, the term “French Public Real Estate Market“ refers to all forms of listed or unlisted financial investment using real estate as a support. To conduct our study, we analyzed four dierent types of real estate investment vehicles : SCPIs (Société Civile de Placement Immobilier), OPCIs (Organisme de Placement Collectif Immobilier), SIICs which corresponds to REITs (Société d’Investissement Immobilier Côté) and SCIs en UC (Société Civile Immobilière en Unité de Compte). Regarding the scope of our analysis, we analyzed a total of 204 real estate funds managed by 78 asset management companies.

A total capitalization of the Public Real Estate Funds market represents more than €183 billion, an increase by 11% compared with 2021. This growth was possible mainly thanks to the strong expansion of the SCPIs and SCIs vehicles.

The historical vehicles, SCPIs raised €10.3 billion of new funds in 2022, beating the 2019’s record. As for SCIs, these vehicles collected €5.7 billion, and lastly OPCIs inflow is still marginal with €465 million but nonetheless, are contributing to the growth of the market.

SCPIs remain the most represented vehicles

On 31 December 2022, SCPIs represented a total capitalization of nearly €86 billion, followed by SIICs valued at €46.8 billion. Last, but not least, OPCIs represent €20.1 billion of total net assets.

According to available data, SCIs represent a total net asset value of €30.1 billion. These funds are benefiting from a strong interest amongst insurer investors and fund managers who do not stop to launch new SCIs vehicles and to open their existing SCs to the public investors. In 2022, the average annual performance per share was 3.13%. Only available within a life insurance contract, the SCIs vehicles also allow investors to benefit from tax advantages provided by this form of saving.

On the other hand, OPCIs had a negative annual performance of -3.54% over 2022. This performance is mainly explained by the exposure of one of its subcomponents to volatile REITs and other financial instruments.

SIICs (french REITs) suffered a fall in their stocks market valuation due to the current macroeconomic conditions averaging with -14.38% during 2022. Something that should not be forgotten is that these vehicles are using a strong leverage in their business model. It allows them to create value by developing new assets and redeveloping older ones, while ensuring dividend return for shareholders. For the fiscal year of 2022, French SIICs offered a dividend rate return of 4.09% : it corresponds to the ratio between dividends paid in 2022 over the 2021 result, and the share price on the 1st of January 2022.

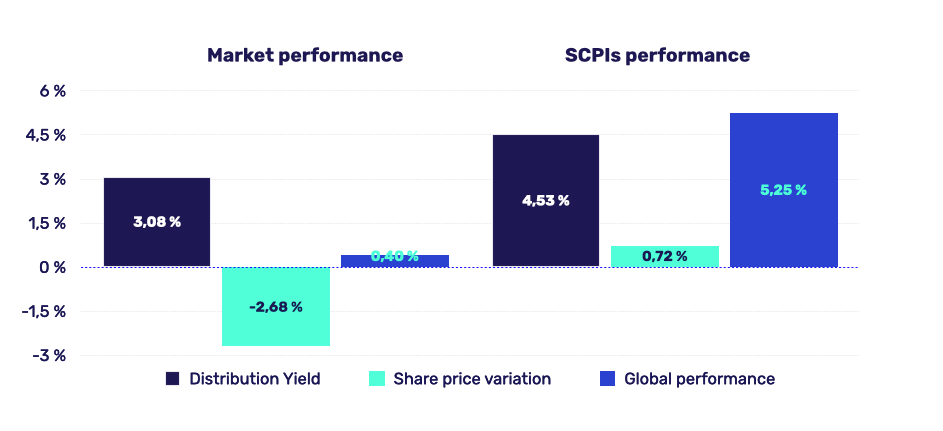

Regarding SCPIs, they delivered an average distribution yield of 4.53% and an average appreciation of their share price of 0.72%. Once again, SCPIs confirmed their resilient nature by maintaining all their indicators in the green.

On average, the French Public Real Estate Funds show a distribution yield of 4.64% (excluding OPCIs and SCIs) and an annual revaluation of -2.68%.

On average, each French citizen invested €247 in Public Real Estate Funds in 2022

During an inflationary period, it is very important to protect the purchasing power of savings by placing them towards resilient and safe investments. In 2022, a French citizen saved an average of €247 in Public Real Estate Funds.

New Assets Types available to public investors

Besides traditional commercial assets such as offices and retail, which captured the majority of investments in 2022, professional investors are also turning to alternative asset classes.

Logistics, Healthcare and Education properties are attracting more and more SCPIs. These real estate classes deliver superior and more attractive performances in the long term with longer tenant engagements.

Public Real Estate Funds allow investors to access these different typologies of commercial real estate from €187.

About Rock-n-Data

Created by real estate professionals, Rock-n-Data is an independent professional platform dedicated to the real estate industry and to real estate public investors.

We allow you to follow the performance of more than 200 real estate investment vehicles, as well as the asset characteristics of over 14,000 properties owned by the funds we follow in France and Europe.

To learn more, please visit https://www.rock-n-data.io/fr/

Media Contact

Company Name: Rock-n-Data

Contact Person: Rock-n-Data

Country: United States

Website: https://www.rock-n-data.io/fr/